Streamlined insurance approvals through direct repair programs (DRPs) revolutionize collision repair, cutting turnaround times, boosting customer satisfaction, and enhancing operational efficiency. Faster DRP approvals lead to quicker claim settlements, resource optimization, and improved service quality, fostering loyalty, driving business growth, and meeting modern demands for swift auto body repairs.

In today’s competitive automotive industry, understanding the advantages of streamlined insurer approvals for Direct Repair Programs (DRPs) is crucial. This article explores how efficient approval processes unlock significant operational benefits, enhance customer experiences, and drive business success. We delve into key strategies, including automating workflows, improving communication, and fostering stronger partnerships with insurers. By embracing streamlined approvals, repair shops can navigate the ever-evolving landscape with agility and confidence.

- Unlocking Efficiency: Streamlined Approvals for Direct Repair Programs

- Enhancing Customer Experience: Faster, Seamless Insurer Approvals

- The Impact: How Streamlined Approvals Drive Business Success

Unlocking Efficiency: Streamlined Approvals for Direct Repair Programs

Unlocking Efficiency: Streamlined Approvals for Direct Repair Programs

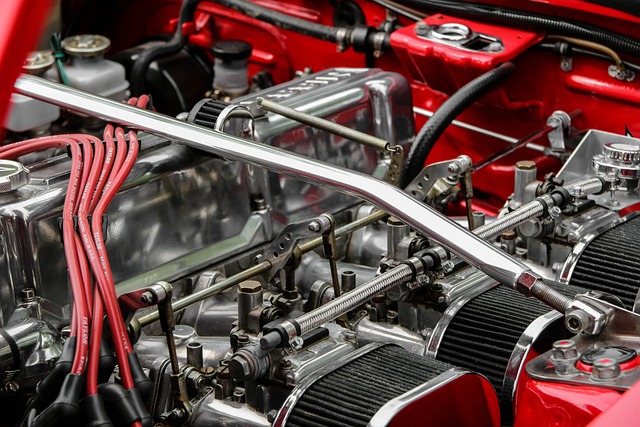

In today’s fast-paced world, efficiency is key for any business aiming to stay competitive. For collision repair centers participating in direct repair programs (DRPs), streamlined insurer approvals can significantly enhance operational effectiveness. By simplifying the approval process, these centers can reduce turnaround times and improve customer satisfaction. This means faster repairs, less waiting time for clients, and better utilization of resources.

Streamlined approvals allow for quicker decision-making, enabling collision repair professionals to focus on what they do best: fixing vehicle bodywork and restoring vehicle paint repair to its highest standards. With direct communication between repair centers and insurers, the entire process becomes more transparent and seamless. This benefits both parties—insurers gain a reliable network of approved repair facilities, while collision repair centers enjoy increased business and enhanced reputation as trusted partners in vehicle maintenance.

Enhancing Customer Experience: Faster, Seamless Insurer Approvals

In today’s fast-paced world, customers expect quick and efficient service from their auto body shops and vehicle repair centers. Streamlined insurer approvals play a pivotal role in enhancing customer experience by reducing turnaround times significantly. When a vehicle undergoes repairs through a direct repair program, the approval process becomes more seamless and faster. This means less waiting time for customers, who can get their vehicles back on the road promptly.

The benefits extend beyond convenience; it also fosters trust between the repair center and its clients. Faster approvals allow auto body shops to focus on delivering high-quality vehicle paint repairs and ensuring customer satisfaction. By streamlining the process, these shops can offer a more efficient service, catering to modern customers’ demands for quick turnarounds without compromising on the quality of their work.

The Impact: How Streamlined Approvals Drive Business Success

In today’s fast-paced business environment, efficient operations are a key differentiator for success. Streamlined insurer approvals play a pivotal role in this regard, significantly impacting overall business performance. When insurance approval processes are simplified and accelerated, it triggers a cascade of positive effects. For businesses specializing in auto body repairs, hail damage repair, or auto glass replacement, such improvements can be transformative.

Faster approvals lead to quicker claim settlements, enabling businesses to efficiently manage workflows and reduce administrative burdens. This, in turn, allows them to allocate resources more effectively, focusing on delivering high-quality services like direct repair programs. As a result, customers benefit from faster turnaround times and seamless experiences, fostering loyalty and positive word-of-mouth referrals. Ultimately, streamlined insurer approvals act as a catalyst for business growth, ensuring operations run smoothly and competitively in the market.

Streamlined insurer approvals are a game-changer for the automotive industry, particularly within Direct Repair Programs (DRPs). By simplifying the approval process, insurers and repair shops can enhance customer satisfaction and unlock significant operational efficiency. This approach not only accelerates vehicle repair times but also fosters stronger relationships between stakeholders, ultimately driving business success and improving overall service quality in the DRP ecosystem.