Insurers' approval processes in Direct Repair Programs (DRPs) streamline car repair for customers, mechanics, and insurers alike, reducing turnaround times and enhancing resource utilization. Digital tools automate tasks, improve communication, and enable real-time updates, fostering efficiency and strengthening market reputations through improved customer experiences.

“Unraveling the advantages of streamlined insurer approvals is pivotal in enhancing the efficiency of direct repair programs (DRPs). Efficient and streamlined processes are key to ensuring seamless customer experiences. By simplifying approval mechanisms, auto repair shops can significantly boost client satisfaction within DRP frameworks. This article delves into three critical aspects: efficient approvals as a DRP cornerstone, the positive impact on customer experience, and the transformative role of digital technology in accelerating insurer sign-offs.”

- Efficient Approvals: The Key to Seamless Direct Repair Programs

- Streamlined Process: Enhancing Customer Experience and Satisfaction

- Digital Transformation: How Technology Speeds Up Insurer Approvals

Efficient Approvals: The Key to Seamless Direct Repair Programs

Insurers’ approval processes can significantly impact the success and efficiency of direct repair programs (DRPs). Streamlined approvals are the linchpin ensuring a seamless experience for both insurers and auto repair shops. When DRP initiatives are in place, efficient insurer approvals mean faster turnaround times for damaged vehicles. This is particularly beneficial for auto repair shops as it reduces the number of days a vehicle spends in their workshop due to pending insurance clearance.

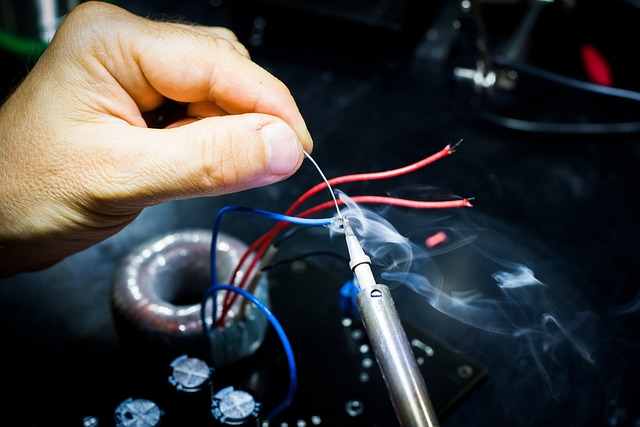

A swift approval process allows mechanics to focus on what they do best – repairing cars. It enables them to utilize their skills and resources effectively, especially when dealing with seemingly minor issues like dent removal or larger repairs after a fender bender. Ultimately, streamlined insurer approvals contribute to improved customer satisfaction by accelerating the overall repair process.

Streamlined Process: Enhancing Customer Experience and Satisfaction

In today’s fast-paced world, customers expect quick and efficient service, especially when it comes to important matters like car repairs. Streamlined insurer approvals play a pivotal role in enhancing the customer experience by simplifying the process of obtaining necessary fixes. When an insurance company implements a direct repair program, it allows policyholders to connect directly with pre-approved auto body shops, eliminating the hassle of lengthy approval procedures. This efficiency is a game-changer for customers, as it means faster turnaround times and less back-and-forth communication.

By facilitating smoother interactions between insurers, repair shops, and policyholders, streamlined processes benefit everyone involved. Customers are satisfied with their timely and convenient automotive restoration services. Moreover, insurance companies can manage claims more effectively, reducing administrative burdens. This improved customer experience not only fosters loyalty but also strengthens the relationship between insurers and their clients, ultimately contributing to a positive reputation in the market for both parties.

Digital Transformation: How Technology Speeds Up Insurer Approvals

The digital transformation has brought about a significant shift in how insurance companies operate, particularly when it comes to approvals. With technology advancing at an unprecedented rate, insurers are now leveraging digital solutions to streamline their processes, leading to faster turnarounds for both claims and repairs. One notable example is the implementation of the Direct Repair Program (DRP), which allows for efficient communication and coordination between insurers, repair shops, and vehicle owners. This program facilitates seamless car paint services and autobody repairs by providing a standardized platform for managing claims, authorizing repairs, and ensuring quality control.

By embracing digital tools, such as cloud-based systems, artificial intelligence (AI), and data analytics, insurance companies can automate many manual tasks that were once time-consuming. For instance, AI algorithms can quickly analyze repair estimates, identify potential fraud, and approve or deny claims based on pre-set criteria. This not only reduces the administrative burden on staff but also enables them to focus on more complex cases. Additionally, digital platforms enable real-time updates, allowing all stakeholders to stay informed about the status of repairs, including vehicle owners waiting for their cars to be returned after necessary vehicle paint repair or autobody repairs.

Streamlined insurer approvals are a game-changer in the automotive industry, especially for successful implementation of direct repair programs. By simplifying and accelerating the approval process through digital transformation, businesses can enhance customer satisfaction and provide a more seamless experience. This efficient approach is key to staying competitive in today’s market, ensuring swift and accurate decision-making that benefits both repairs and relationships.