Automated claim routing within Direct Repair Programs (DRPs) optimizes insurance claim handling through advanced algorithms and data analytics. This system efficiently directs vehicles needing paint services or repairs to specialized facilities based on location, expertise, and capacity, minimizing delays and enhancing customer satisfaction. Automation digitizes claim processing, reduces human error, and paperwork, allowing adjusters to focus on complex cases while automated systems handle routine tasks for quicker turnarounds. The benefits include lower operational costs for insurance companies, faster repair times, and improved quality, contributing to a smoother overall process in the competitive market.

“Unleash efficiency and enhance customer satisfaction with automated claim routing—a game-changer in the insurance industry. This article explores the transformative power of automation in streamlining complex processes, from initial claim assessment to final settlement. We delve into how this technology reduces manual errors, accelerates turnaround times, and fosters transparency through case studies showcasing its real-world impact. Furthermore, we examine the strategic cost savings and improved risk mitigation associated with automated claim processing, particularly when integrated with Direct Repair Programs, ensuring policyholder convenience and satisfaction.”

- Streamlining Claim Processing with Automated Routing

- – How automation improves efficiency and reduces manual errors in claim handling.

- – Case studies demonstrating faster turnaround times and increased productivity.

Streamlining Claim Processing with Automated Routing

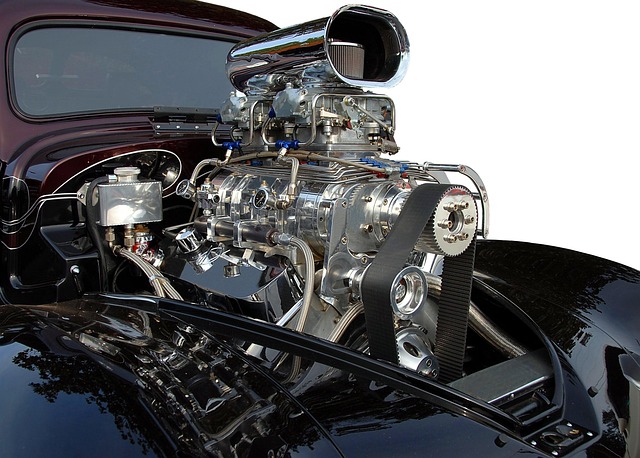

Automated claim routing significantly streamlines the process of handling insurance claims, particularly within the context of a Direct Repair Program (DRP). By employing advanced algorithms and data analytics, automated systems efficiently route claims to the nearest or most capable repair facility based on various factors like location, specialization, and capacity. This ensures that cars requiring car paint services or car paint repairs are directed to facilities with expertise in vehicle paint repair, minimizing delays and enhancing customer satisfaction.

Moreover, automation reduces human error and paperwork by digitizing claim processing. Adjusters can focus on complex cases while automated systems handle routine tasks, enabling quicker turnarounds for simple claims. This efficient routing not only benefits insurance companies by lowering operational costs but also guarantees that cars in need of repairs receive prompt and quality car paint services or vehicle paint repair, contributing to a smoother overall process.

– How automation improves efficiency and reduces manual errors in claim handling.

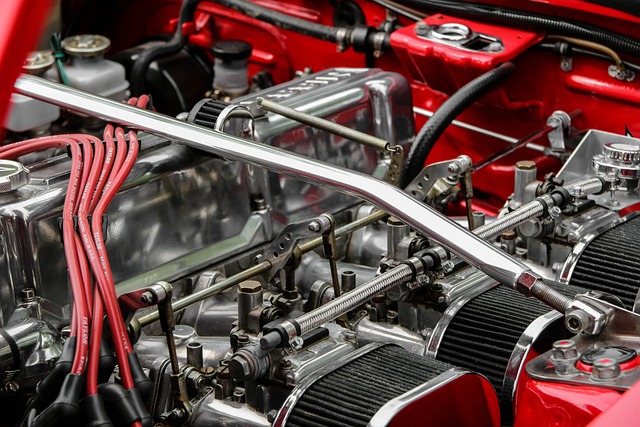

Automation revolutionizes claim handling processes, significantly enhancing efficiency and accuracy. By implementing automated systems for routing claims, insurance companies streamline their operations, ensuring faster turnaround times. This technology intelligently directs claims to the most suitable auto collision center or auto body work specialists, reducing manual intervention. With automated processes in place, human errors commonly associated with traditional methods are minimized, leading to more consistent and reliable outcomes.

This digital approach benefits all stakeholders, from insurance providers to policyholders and collision repair shops. Policyholders experience quicker claim settlements, while auto body work professionals benefit from a simplified process that allows them to focus on delivering high-quality repairs. The direct repair program is facilitated through automation, ensuring seamless communication and coordination among parties involved in the complex web of collision repair services.

– Case studies demonstrating faster turnaround times and increased productivity.

In today’s fast-paced business environment, automated claim routing is transforming the way car body shops and direct repair programs operate. Case studies from leading automotive service providers reveal dramatic improvements in turnaround times and overall productivity. For instance, one prominent car dent repair shop implemented an automated system, reporting a 25% reduction in average claim processing time. This efficiency gain translates to faster repairs and satisfied customers.

Furthermore, the integration of automation has enabled these car repair services to handle a higher volume of claims without significantly increasing overhead costs. This is particularly beneficial for direct repair programs looking to expand their reach. By streamlining the initial assessment and routing phases, automated systems allow specialized car body shops to dedicate more resources to complex repairs, ensuring top-notch quality in every service provided.

Automated claim routing is a game-changer for streamlining insurance processes, particularly within Direct Repair Programs (DRPs). By leveraging technology, insurers can significantly enhance efficiency, reduce manual errors, and achieve faster turnaround times. Case studies highlight the success of these automated systems in boosting productivity, proving that embracing digital solutions is key to staying competitive in today’s insurance landscape.